Introduction

Budgeting doesn’t have to be complicated. One of the most popular and beginner-friendly budgeting methods is the 50/30/20 rule. It’s simple, effective, and works whether you’re a student, remote worker, or someone looking to finally take control of your finances. In this guide, we’ll break down what the 50/30/20 rule is, how it works, and how you can start using it today.

What is the 50/30/20 Rule?

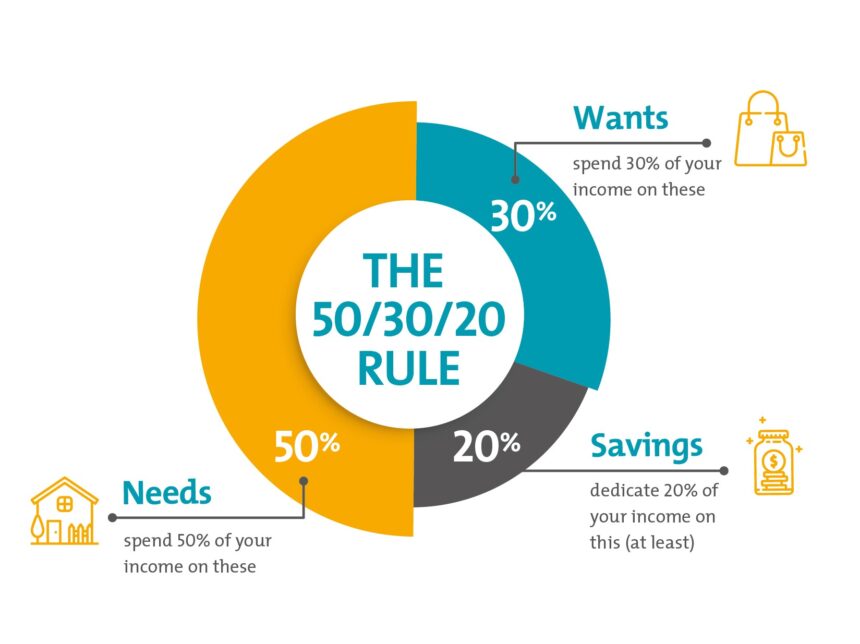

The 50/30/20 rule is a budgeting strategy that divides your after-tax income into three categories:

- 50% for Needs 🏠 – Rent, groceries, transport, utilities, insurance.

- 30% for Wants 🎉 – Eating out, entertainment, shopping, travel.

- 20% for Savings & Debt Repayment 💰 – Emergency fund, investments, extra debt payments.

This method ensures you cover your essentials, enjoy life, and still save for the future.

Why the 50/30/20 Rule Works

- Simple to follow – No complex spreadsheets or calculations.

- Flexible – Works for freelancers, remote workers, and salaried employees.

- Balanced lifestyle – You don’t have to cut out fun completely.

- Builds financial discipline – Encourages consistent saving and debt reduction.

Step-by-Step: How to Apply the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Know your actual income after taxes and deductions.

Step 2: Allocate 50% to Needs

List all essential expenses. If you’re above 50%, cut back on luxury needs like premium subscriptions.

Step 3: Allocate 30% to Wants

Be intentional – track your discretionary spending and set a monthly limit.

Step 4: Allocate 20% to Savings & Debt

Automate transfers to savings accounts, retirement funds, or debt repayment.

Example Budget (R20,000 Monthly Income in South Africa)

- Needs (50%) → R10,000 (rent, groceries, transport)

- Wants (30%) → R6,000 (restaurants, entertainment, shopping)

- Savings/Debt (20%) → R4,000 (emergency fund, credit card repayment, investments)

Pros & Cons of the 50/30/20 Rule

✅ Pros

- Easy to understand

- Works for beginners

- Encourages saving & debt repayment

❌ Cons

- Not ideal for low-income earners (needs might exceed 50%)

- Doesn’t account for big financial goals like buying property

Alternatives to the 50/30/20 Rule

- 70/20/10 Rule – 70% needs, 20% savings, 10% wants

- Zero-Based Budgeting – Every rand gets assigned a role

- 80/20 Rule – 80% expenses, 20% savings

Conclusion

The 50/30/20 rule is a powerful starting point for anyone learning to budget. It balances financial discipline with lifestyle freedom. Whether you earn in rands, dollars, or euros, applying this method can set you on the path to financial success.

FAQ

Q1: Is the 50/30/20 rule realistic in South Africa?

Yes, but it depends on your cost of living. In big cities like Johannesburg or Cape Town, housing may exceed 50%. Adjust to your reality.

Q2: Can freelancers use the 50/30/20 rule?

Absolutely! As long as you calculate your after-tax income correctly, it works well for freelancers and remote workers.

Q3: What if my needs are more than 50%?

Reduce wants, or adjust the rule to 60/20/20 until your income grows.

Q4: Which apps help track the 50/30/20 rule?

Try 22seven (South Africa), YNAB (You Need A Budget), or Mint.

💡 Affiliate Opportunity:

- Budgeting apps like 22seven, YNAB, or Quapital.

- Financial literacy courses (Coursera, Udemy).

- Banking partners (Capitec, FNB smart accounts).