Introduction

In this guide, we’ll explore the best Budgeting Apps for Remote Workers in 2025 that can help remote workers track expenses, save more, and plan for the future.

Remote work has given people the freedom to work from anywhere—but it has also introduced new financial challenges. From fluctuating income to managing travel expenses, staying on top of your budget is crucial.

Table of Contents

1. Why Budgeting Apps for Remote Workers Essential

Remote work often means:

- Variable income (freelance or contract work)

- Different currencies when working internationally

- Higher personal responsibility for taxes and benefits

- Possible travel expenses for digital nomads

Budgeting apps can automate tracking, categorize spending, and provide valuable insights—helping you make better financial decisions.

2. Top Budgeting Apps for Remote Workers in 2025

a) YNAB (You Need A Budget) – Best for Zero-Based Budgeting

- Helps you assign every dollar a job.

- Cloud sync across devices.

- Great for planning months ahead.

Pricing: $14.99/month or $99/year

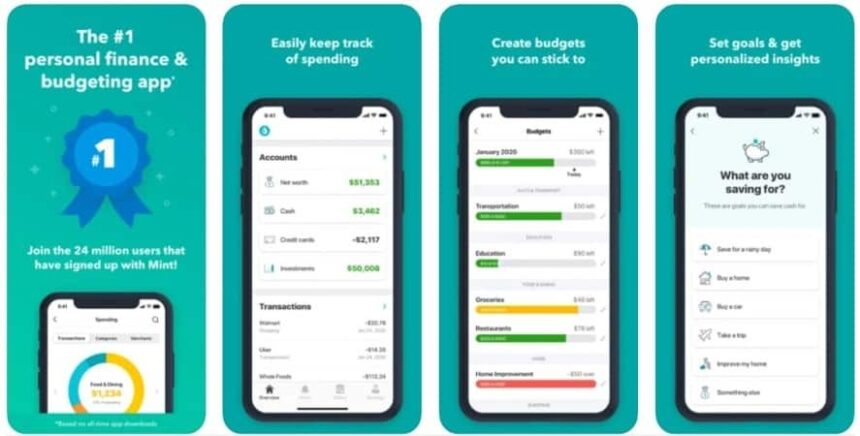

b) Mint – Best for All-in-One Expense Tracking

- Links to bank accounts & cards.

- Free credit score monitoring.

- Smart budgeting suggestions.

Pricing: Free (with ads)

c) PocketGuard – Best for Simplicity

- Shows “what’s left to spend” after bills & savings.

- Bank-grade security.

Pricing: Free or $7.99/month for Plus

d) Goodbudget – Best for Envelope Budgeting

- Digital envelope system.

- Ideal for couples or teams.

Pricing: Free or $8/month

e) Revolut – Best for Digital Nomads

- Supports multi-currency accounts.

- Built-in analytics for spending.

Pricing: Free & paid plans from $9.99/month

3. How to Choose the Right Budgeting Apps for Remote Workers

- Consider your income type (fixed vs. variable)

- Check multi-currency support if you travel

- Evaluate reporting tools for tax planning

- Test free trials before committing

4. Affiliate Recommendations

If you’re a blogger, influencer, or content creator, you can earn affiliate income by reviewing and recommending budgeting apps.

- Finance Affiliate Networks: CJ Affiliate, Impact, ShareASale

- Direct App Affiliates: YNAB, Revolut, PocketGuard

Conclusion

The right budgeting app can turn financial stress into financial clarity. Whether you prefer detailed analytics, simple tracking, or multi-currency features, there’s an app for you in 2025. Try a few, stick with one, and watch your financial confidence grow.

FAQs

Q1: Are budgeting apps safe?

Yes, most use bank-grade encryption and never store your credentials in plain text.

Q2: Can I use these apps if I get paid in multiple currencies?

Yes, Revolut and YNAB are great for handling multiple currencies.

Q3: Are there free budgeting apps?

Yes, Mint, PocketGuard (basic), and Goodbudget offer free plans.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Mirror links provide uninterrupted gambling